- (316) 555-0116

- info@la-studioweb.com

- 4517 Washington Ave. Manchester, Kentucky 39495

Accounting Principles: A Business Perspective Open Textbook Library

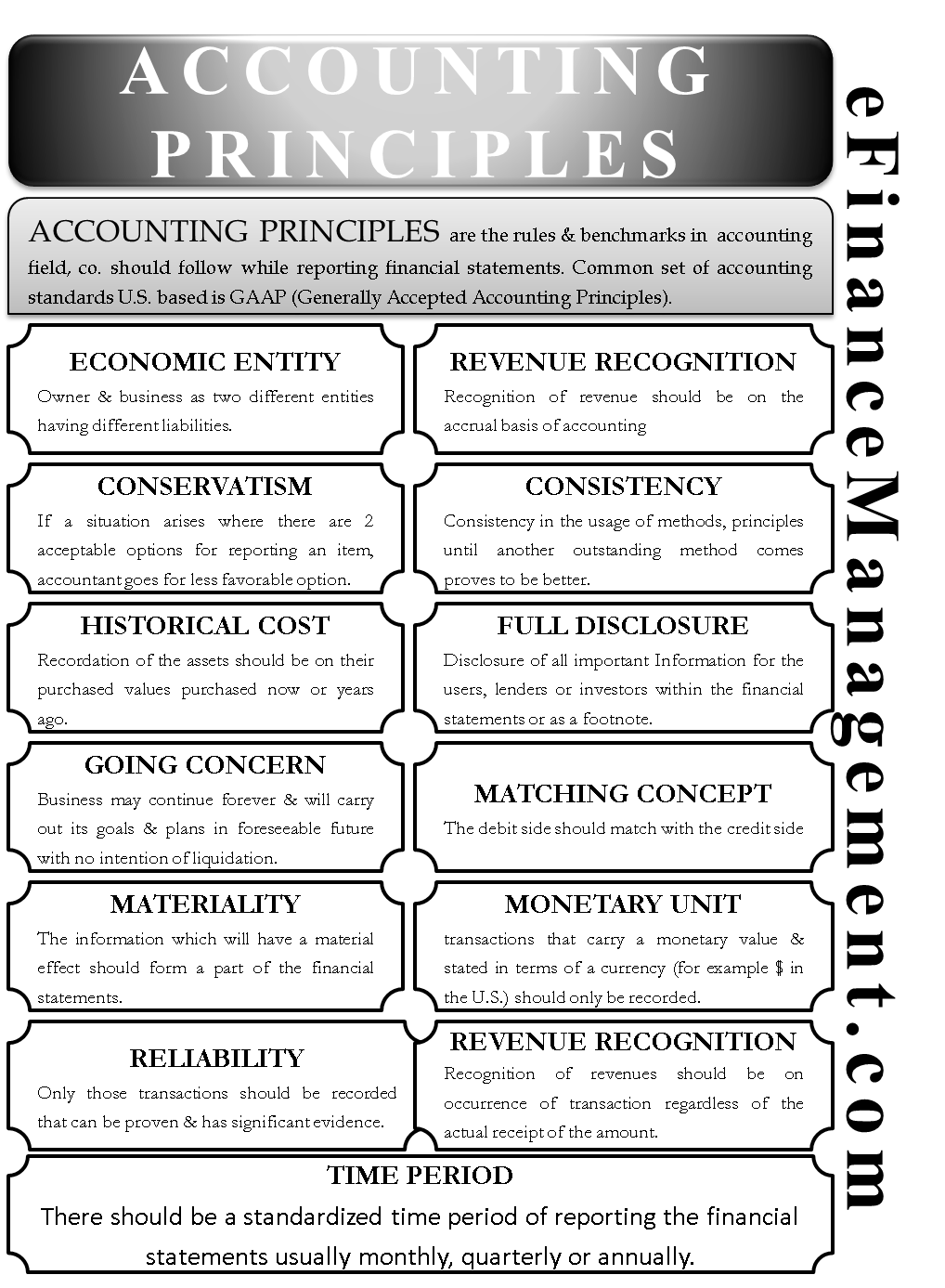

When every company follows the same framework and rules, investors, creditors, and other financial statement users will have an easier time understanding the reports and making decisions based on them. In this case, we’re discussing number one, the basic accounting principles that dictate how your accountant does their job. These accounting principles guarantee consistency in accounting reports and financial statements among all businesses and therefore, help protect business owners, consumers, and investors from fraud. Ultimately, then, the more you understand about these basic accounting principles, the easier it will be to work with any accounting professional you hire for your business. Chapter 1 presents a broad overview of accounting which is common in financial accounting texts. As I mentioned previously, chapter 2 makes the assumption that students already grasp at this early stage what revenues and expenses are and the differences between cash and accrual accounting.

1 Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements

There are many format options that are common to OpenStax textbooks that make this book a very accessible and usable book. This text includes some very relevant information about careers in accounting. I did not see a tie-in with data analysis which would have been nice but there are other ways to integrate this in to a course. After reviewing the book, and the accompanying resources I will consider adopting it for use in my classes. If not as a primary resource, I will recommend the source as an additional reading option for my students. I’ve used two textbooks for my course in the last five years and the information is comparable.

How confident are you in your long term financial plan?

If you were making a profit and loss statement for the first quarter of the year, for example, you wouldn’t cover transactions that occurred before or after the quarter. This ensures that the company can accurately compare performance in different time periods. Generally Accepted Accounting Principles are important because they set the rules for reporting and bookkeeping. These rules, often called the GAAP framework, maintain consistency in financial reporting from company to company across all industries. Industry Practices Constraint – some industries have unique aspects about their business operation that don’t conform to traditional accounting standards. Thus, companies in these industries are allowed to depart from GAAP for specific business events or transactions.

Auditing of Publicly Traded Companies

LLC structures allow business owners to separate their personal finances from the company’s finances. Owners of LLCs cannot be held personally liable for debts incurred solely by the company. Accountants also distinguish between current and long-term liabilities. Current liabilities are liabilities due within one year of a financial statement’s date. As an example, consider a company that outsourced work to an external contractor.

GAAP vs. IFRS

Companies on U.S. exchanges to provide GAAP-compliant financial statements. Investors should be cautious if a financial statement isn’t prepared using GAAP. Comparing financial statements steps to complete irs form 5695 across different companies—even within the same industry—becomes challenging without GAAP. Some companies may use GAAP and non-GAAP measures to report their financial results.

Accounting Period Concept

This means that we must assume the company isn’t going to be dissolved or declare bankruptcy unless we have evidence to the contrary. Thus, we should assume that there will be another accounting period in the future. Periodicity Assumption – simply states that companies should be able to record their financial activities during a certain period of time.

- This means that interpretation and guidance on US GAAP standards can often contain specific details and guidelines in order to help align the accounting process with legal matters and tax laws.

- Still, caution should be used, as there is still leeway for number distortion under many sets of accounting principles.

- If not as a primary resource, I will recommend the source as an additional reading option for my students.

- As of June 2024, the United States has not fully adopted IFRS principles, and domestic U.S. companies remain bound to GAAP reporting guidelines.

- The chapters build on one another and flow from one to the other effortlessly.

In the United States, generally accepted accounting principles (GAAP) are regulated by the Financial Accounting Standards Board (FASB). In Europe and elsewhere, International Financial Reporting Standards (IFRS) are established by the International Accounting Standards Board (IASB). Generally accepted accounting principles (GAAP) are uniform accounting principles for private companies and nonprofits in the U.S. These principles are largely set by the Financial Accounting Standards Board (FASB), an independent nonprofit organization whose members are chosen by the Financial Accounting Foundation.

Following GAAP guidelines and being GAAP compliant is an essential responsibility of any publicly traded U.S. company. GAAP is a set of detailed accounting guidelines and standards meant to ensure publicly traded U.S. companies are compiling and reporting clear and consistent financial information. Any company following GAAP procedures will produce a financial report comparable to other companies in the same industry.

It needs to be explain now even though the tools are evolving quickly to be cloud based and app based. Some chapters are not organized naturally (e.g. AIS.) The student is learning about inventory and then immediately accounting information systems in the next chapter. I like the content in the chapter but either early on as a basis for understanding tools that accountants use or at the end. In teaching from this book – I would be forced to skip chapters and introduce chapters out of order. There are too many chapters (provides options for instruction who emphasize certain chapters over others) but a concern is the way the text is constructed. Joe is a hard worker and a smart man, but admits he is not comfortable with matters of accounting.

- ! Без рубрики

- "mostbet Brasil: Guia De Apostas Completo – 182

- "mostbet Euro 2024 Critique And Tips – 979

- +btoct

- 1

- 10000_ru

- 1win uzbekistan

- 2

- 7430_tr

- 8040_ru

- 8800_ru

- 8900_ru

- 8900_ru2

- 8930_ru

- 9080_ru

- 9150-2_ru

- 9185_ru

- 9200_ru

- 9200_ru2

- 9270_ru

- 9300_ru

- 9330_ru

- 9400_ru

- 9460_ru

- 9500_2ru

- 9500_3ru

- 9560_ru

- 9620_ru

- 9750_ru

- 9820_ru

- abilify

- adderall

- AI News

- ai-bit-invest.com

- ai-bit-invest.org

- anticoagulantia

- Apostas Em Brasil X Estados Unidos Nas Olimpíadas 2024 – 943

- Arts & Entertainment, Music

- Best Mnf Betting Promotions & Bonuses: Get $6000+ For Jets-bills Monday Night Basketball Odds – 546

- Bet Hip Hop Honours 2024 Highlights Gamble Hip Hop Honours 2024 Video Playlist Bet Hiphop Awards – 621

- bhnov

- bhoct

- blog

- Blog Oficial Brasil Login 30 Rodadas Grátis – 742

- Bookkeeping

- btbtnov

- Carabao Cup Predictions, Betting Tips & Greatest Bets – 962

- casino

- casino-game

- casino-online

- chnov

- Como Sacar Na Slottica Boas Vindas Generoso – 248

- Coral Gold Mug Betting: Top 2023 Coral Gold Cup Odds And Tips – 206

- Cosmetic

- cosmetology school toronto

- credito

- Cryptocurrency service

- Declare Your Own Nice Welcome Bonus At Ozwin Casino! – 355

- Delightful To Ozwin Find Out The Particular Greatest Neosurf Additional Bonuses – 773

- done 240244

- dytyna.blog

- ed

- fi

- FinTech

- Forex Trading

- g

- Get Your Mind And Your Coronary Heart Into The Online Game Using The Mostbet App – 386

- gewichtsverlies

- Hard Mountain Bet Virginia Promo Code: Bet $5, Get $100 – 858

- Health & Fitness, Beauty

- Health and Lifestyle

- ironwallet: Crypto Btc Wallet On The Particular App Store – 880

- it

- IT Education

- IT Vacancies

- IT Вакансії

- IT Образование

- ivermectine

- jugabet

- levitra

- MBnov

- mostbet

- Mostbet Added Bonus Code: Pick Way Up The Most Effective Promo Just Before You Sign Up – 567

- Mostbet App Not Necessarily Working 2024 Attempt These Simple Fixes – 618

- Mostbet Casino Pa October 2024 – 428

- Mostbet Cheltenham Betting Offers: Bet £10, Find £30 Day One – 25

- Mostbet Élite: Le Tableau Des Transferts De La Saison 2024-2025 – 766

- Mostbet Mobil Türkçe Indir Mostbet Apk Telefonunuzda Mostbet Uygulama Mostbet Android Os Ve Iphone – 329

- Mostbet Promo Signal For Nfl Bets Offers $200 Benefit Or $1k First-bet For Bengals Compared To Giants – 507

- Mostbet Russia

- Najlepsze zakłady

- neon-seo-academy

- New

- New Blog

- News

- nl

- online-casino

- Ozwin Casino 2021 20+25+50 Free Spins No Deposit Bonus – 780

- Ozwin No Deposit Bonus Codes May 2021 Log In Promotions World – 200

- Ozwin Online Casino Reception Play Pokies, Table Video Games, Video Clip Online Poker – 986

- pbnov

- pboct

- Place Your Bets – 669

- porn

- potency

- profit-spike.com

- profit-spike.org

- PU_aug

- punov

- rbnov

- ritalin

- rybelsus

- se

- seo

- shining crown RO

- Slottica 50 Free Spins Nos Seus – 545

- Slottica Casino Au Best Casino Sites In India – 743

- Slottica Casino Jogos Ao Vivo, Excitante Slots E Vários Bônus – 317

- Slottica Casino Play Online Seção De Perguntas Frequentes – 568

- Slottica Opinie Best Bonus Casino Sign Up – 311

- Sober living

- Software development

- stock wave ai

- stockwaveai

- stromectol

- Uncategorized

- waterfrontsouthport.co.uk

- Week 7 Nfl Person Prop Bets: Finest Player Props To Bet From Connor Allen – 256

- Writing & Speaking, Writing

- ебар

- Новосибирск

- Финтех

- Форекс Брокеры

- Форекс обучение

- おすすめのリアルマネーカジノ

© 2023 The Ladies Lounge. DESIGNED BY LookAtMeMarketing